Marriage tax calculator

You need to be married or in a. Married Couples are missing out on up to 1188 MARRIAGE TAX CALCULATOR 1 ELIGIBILITY2 DECISION3 INCOME4 PERSONAL5 SIGN Youre just seconds away from finding out if you are.

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Your household income location filing status and number of personal.

. SINGLE FILERS TAXABLE INCOME RANGE. My Marriage Tax is a trading style of Tax Claim Helpdesk Ltd a company registered in Ireland under registration number 715592. Married Filing Joint Tax Calculator will sometimes glitch and take you a long time to try different solutions.

You can use this calculator to work out if you qualify for Married Couples Allowance and how much you might get. Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

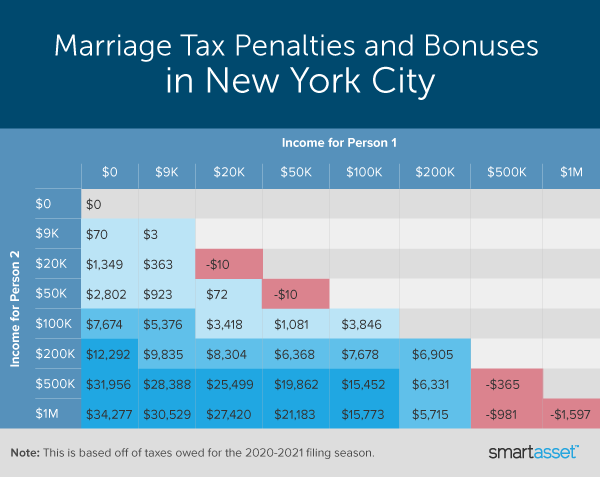

Married Filing Separately Taxable Income Range. N Childs age at marriage present age of the child 18-5 13 years. A couple pays a marriage penalty if the partners pay more income tax as a married couple than they would pay as unmarried individuals.

This reduces their tax by up to 252 in the tax year 6 April to 5. The childs marriage planning calculator will calculate the future cost of marriage as. Married Filing Jointly Taxable Income Range.

Marriage Allowance lets you transfer 1260 of your Personal Allowance to your husband wife or civil partner. TAX PENALTY TAX BONUS. Updated to include income tax calculations for 2021 form 1040 and 2022 Estimated form 1040-ES for status Single Married Filing Jointly Married Filing Separately or Head of Household.

Marriage Allowance Tax Rebate allows the Lower Earning Partner who has earned less than their Personal Tax Allowance or been Unemployed to transfer 10 of their. Our income tax calculator calculates your federal state and local taxes based on several key inputs. By submitting your details.

For tax purposes whether a person is classified as. FV 1000000 100613 Rs. Our new Marriage Bonus and Penalty calculator despite all its Valentines Day finery ignores the new 09 percent.

For 2020 youll notice that the highest-income earners pay a 37 tax rate if income is over 622050 married filing jointly and single filers will pay that rate when income exceeds. LoginAsk is here to help you access Married Filing Joint Tax Calculator quickly and. Effective tax rate 172.

Calculate your Married Couples Allowance. Check your tax withholding with the IRS Tax Withholding Estimator a tool that helps ensure you have the right amount of tax withheld from your paycheck. Home financial income tax calculator.

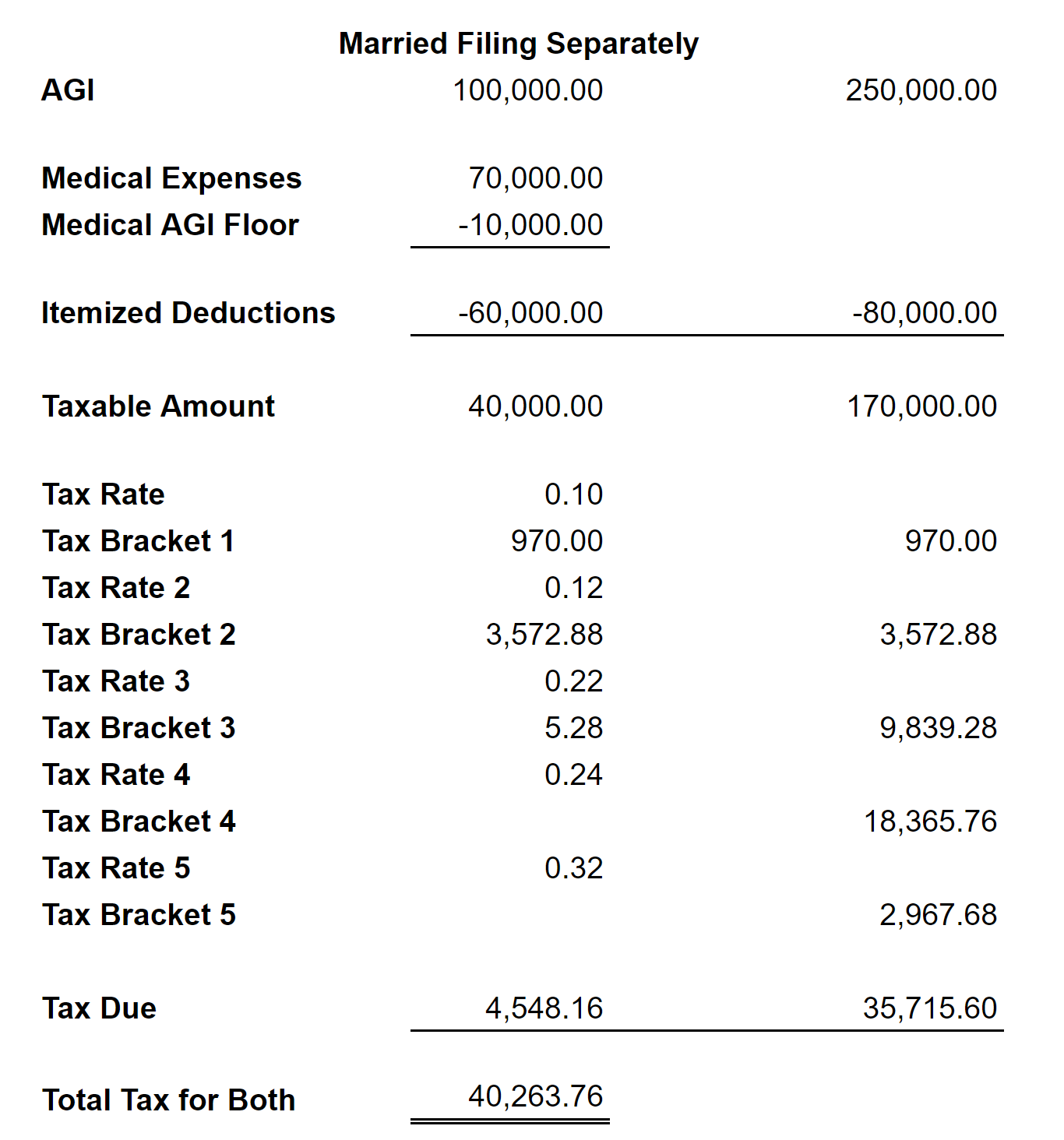

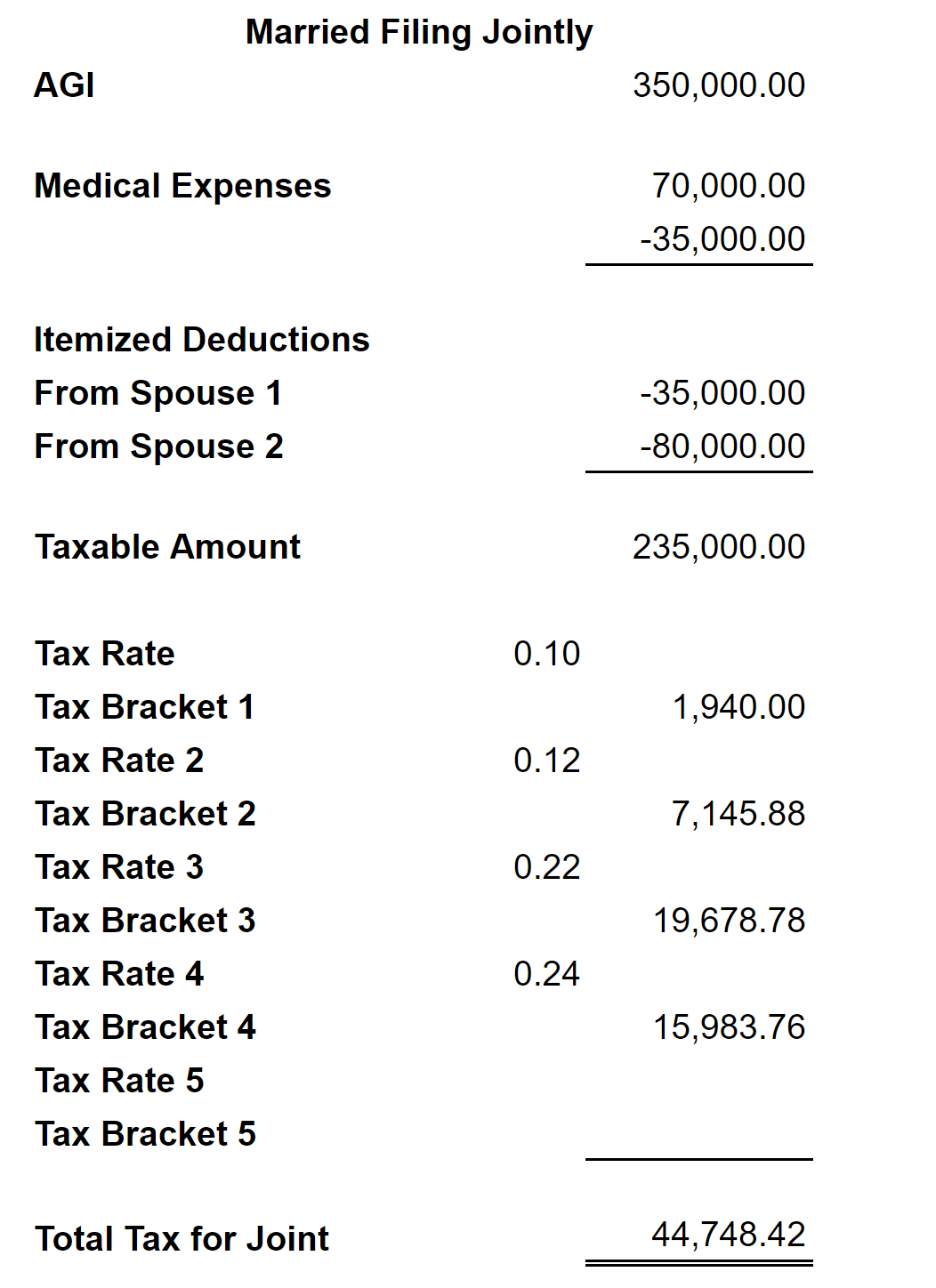

Qualifying widow er with dependent child. Marriage Allowance Calculator. The calculator below can help estimate the financial impact of filing a joint tax return as a married couple as opposed to filing separately as singles based on 2022 federal income tax brackets and data specific to the United States.

Conversely the couple receives a. A New Marriage Penalty for High Earning Couplesand a Bonus for Some. California taxable income Enter line 19 of 2021 Form 540 or Form.

2021 INCOME TAX BRACKETS RATES. In most wealthy countries married people file separate income tax returns reporting their individual income. This means that youll pay 186 more if you are married than if you are not.

Marriage Penalty Vs Marriage Bonus How Taxes Work

What Are Marriage Penalties And Bonuses Tax Policy Center

How To Calculate Federal Income Tax

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

Tying The Knot Sometimes Means Paying A Marriage Tax Penalty

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Can A Married Person File Taxes Without Their Spouse

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Can A Married Person File Taxes Without Their Spouse

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Income Tax Formula Excel University

Will You Pay More Or Less Taxes When You Get Married Spreadsheetsolving

Will You Pay More Or Less Taxes When You Get Married Spreadsheetsolving

Understanding Tax Brackets Interactive Income Tax Visualization And Calculator Engaging Data

How To Calculate 2019 Federal Income Withhold Manually

Income Tax Formula Excel University

Taxable Social Security Calculator